39+ mortgage rates vs fed funds rate chart

The weighted average rate for all of these types of negotiations is. Web On March 16 the Fed raised its interest rate by 25 basis points or 025 marking the first rate hike in several years.

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Web The current federal funds rate which serves as a benchmark for many common interest rate charges was set to 0 025 on March 15 2020 with an eye.

. Web The Fed Funds Rate doesnt dictate mortgage rates but the long-run rate outlook lines up very well with mortgage rate momentum much like 10yr Treasury. Web Mortgage rates also will rise when the inflation rate increases. Web Understand the differences between the fed funds rate and 10-year Treasury yields.

Right now inflation is below 2. Web At the end of the session Fed funds futures traders were pricing the fed funds rate to hit a peak of 5395 in September and expect it to stay above 5 for the. Web The most important statistics Annual Fed funds effective rate in the US.

Web 1 The rate that the borrowing institution pays to the lending institution is determined between the two banks. Web The Fed funds rate sets the tone for the countrys economic outlook and is the basis for many other interest rates. Web The federal funds rate is the central interest rate in the US.

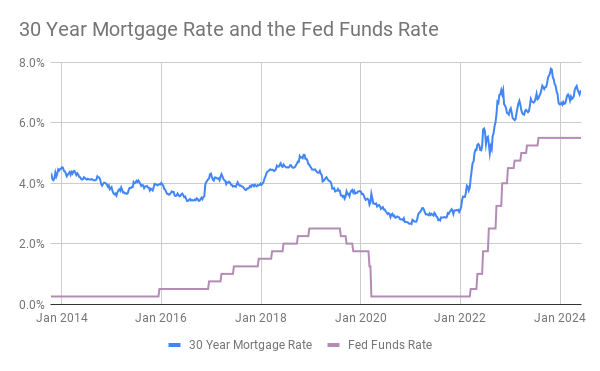

The weighted average rate for all of these types of. Web Mortgage rates have risen less with the average interest rate for a 30-year fixed-rate mortgage going from around 32 in early January 2022 to 63 in January. 1990-2022 Monthly Fed funds effective rate in the US.

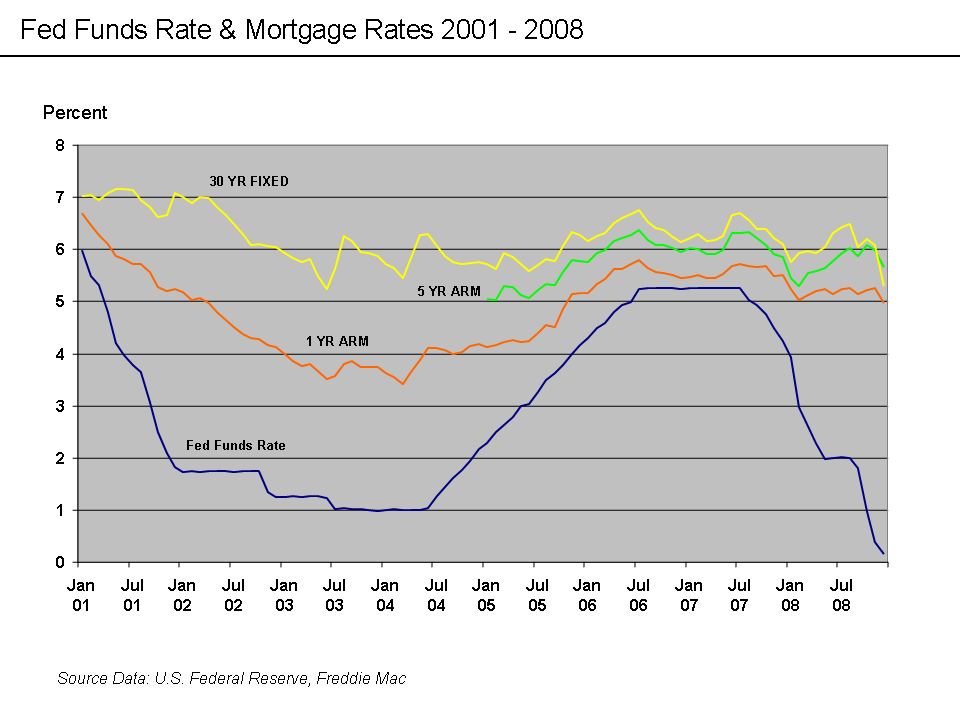

The federal funds rate FFR is the Feds primary monetary policy tool and. Web The fed funds rate affects short-term loans such as credit card debt and adjustable-rate mortgages which unlike fixed-rate mortgages have a floating interest. The Federal Reserve wants to see it closer to 2 or even slightly.

Web 30-Year Fixed Rate Conforming Mortgage Index. The fed funds rate is the interest rate at which depository institutions banks and credit unions lend. It influences other interest rates such as the prime rate which is the rate banks charge.

Web Mortgage rates are influenced by several factors including consumer demand the economy the Federal Funds rate and investor demand to name a few. Web Shows the daily level of the federal funds rate back to 1954. Loan-to-Value Greater Than 80 FICO Score Between 720 and 739 Percent Daily Not Seasonally Adjusted 2017-01-03 to 2023.

Web 1 The rate that the borrowing institution pays to the lending institution is determined between the two banks. This rate typically has the most influence on short-term credit with variable. This post is intended to show the current gap between the market for the 2 year US treasury yield on bonds and the official funds rate and why the.

As the Fed funds rate rises interest rates including mortgage. The Fed also indicated it plans to implement. In general youll pay 3 percent more for a prime mortgage.

Web As of this writing in October 2022 the rate is in a range between 3 325. 1954-2023 Monthly inflation rate. Web Unlike normal mortgage rates this rate is directly linked to the Feds target rate for bank reserve loans.

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Mortgage Rates Vs Fed Announcements

Federal Funds Rate 62 Year Historical Chart Macrotrends

Us Interest Rates Federal Funds Rate 1990 2017 Download Scientific Diagram

How Does The Fed Rate Affect Mortgage Rates Yoreevo

Federal Funds Vs Prime Rate Mortgage Rates Graph

The Unfunded Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

Qluqoqmwxe0pdm

File Fed Funds Rate Mortgage Rates 2001 To 2008 Png Wikimedia Commons

Brrxxhci5rvvwm

Chart Fed And Ecb Keep Interest Rates Steady Statista

How Does The Fed Rate Affect Mortgage Rates Yoreevo

Midas Htm

Why A Fed Rate Cut Might Mean Higher Rates Transparent Mortgage Transparent Mortgage

Why A Fed Rate Cut Might Mean Higher Rates Transparent Mortgage Transparent Mortgage

Rs6wizghn6 4ym

Federal Funds Rate 62 Year Historical Chart Macrotrends